Certified Public Accountant

"Achieve Excellence in accounting: Unlock Global Opportunities with the CPA Qualification"

A CPA (Certified Public Accountant) is a licensed accounting professional with expertise in auditing, tax, financial planning, and consulting. They meet strict education, exam, and experience requirements, uphold ethical standards, and complete ongoing education to maintain their license. The CPA designation is highly respected in the business world.

- (0 Reviews)

Course Features

Learn Anytime Anywhere

Live Lectures

Personal Dashboard

Mobile Access

Level Based Mock Test

End to End Support

Syllabus

|

intro

|

mb |

CPA Syllabus

Audit & Attestation (AUD)

Topics

I - Ethics, Professional Responsibilities and General Principles

II - Assessing Risk and Developing a Planned Response

III - Performing Further Procedures and Obtaining Evidence

IV - Forming Conclusions and Reporting

Financial Accounting & Reporting (FAR)

Topics

I - Financial Reporting

II - Select Balance Sheet Accounts

III - Select Transactions

Taxation & Regulations (REG)

Topics

I - Ethics, Professional Responsibilities and Federal Tax Procedures

II - Business Law

III - Federal Taxation of Property Transactions

IV-Federal Taxation of Individuals

V - Federal Taxation of Entities (including tax preparation)

Business Analysis & Reporting (BAR)

Topics

I - Business Analysis

II - Technical Accounting and Reporting

III - State and Local Governments

Information Systems & Control

Topics

I - Information Systems and Data Management

II - Security, Confidentiality and Privacy

III-Considerations for System and Organization Controls (SOC) Engagements

Tax Compliance & Planning (TCP)

Topics

I - Tax Compliance and Planning for Individuals and Personal Financial Planning

II - Entity Tax Compliance

III - Entity Tax Planning

IV-Property Transactions (disposition of assets)

Learning Outcomes

What is the CPA Program?

• CPA is one of the most prestigious and globally recognized certifications in Accounting & Finance.

• Highly valued across 130+ countries, including India and the USA.

• Average salaries ranging from INR 12.5-20.4 LPA.

• 12 to 18 Months Timeline.

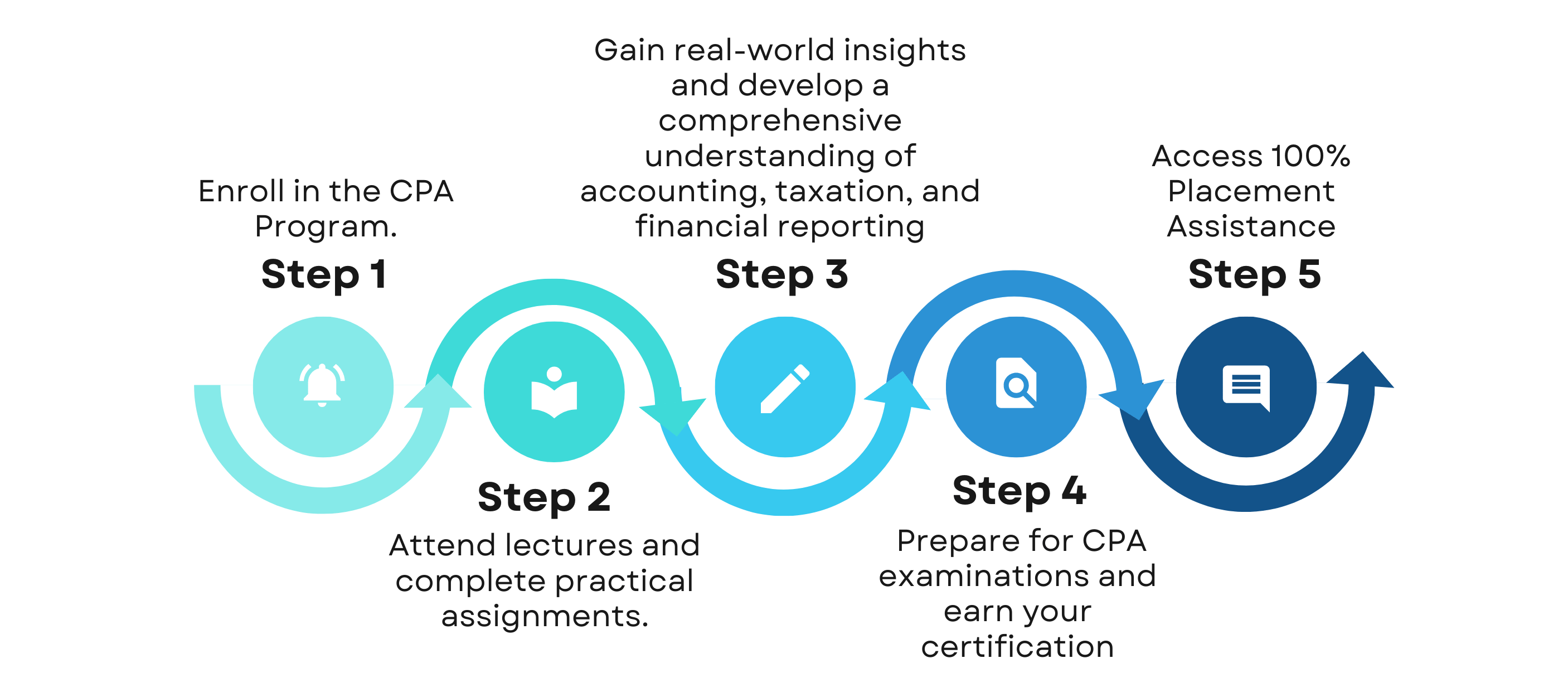

Begin Your CPA Journey with Vantage

CPA Roadmap At Vantage Knowledge Academy

Our Placements

Career Opportunities

CPA Centres In India

Our Faculty

Jobis Kurian

Licensed CPA (North Dakota, USA, since 2013)

Jobis Kurian is a seasoned finance professional with over a decade of experience spanning diverse industries, including Banking, Investment Banking, Real Estate, Financial Services, and Trading. Since earning his CPA qualification, he has held senior leadership roles across multiple countries, managing and mentoring finance teams in dynamic, cross-cultural environments.

Currently based in India, Jobis focuses on advisory and consulting, leveraging his extensive expertise to help businesses navigate complex financial landscapes. He is also a sought-after speaker, frequently participating in career counseling and guidance initiatives across India, inspiring the next generation of finance professionals.